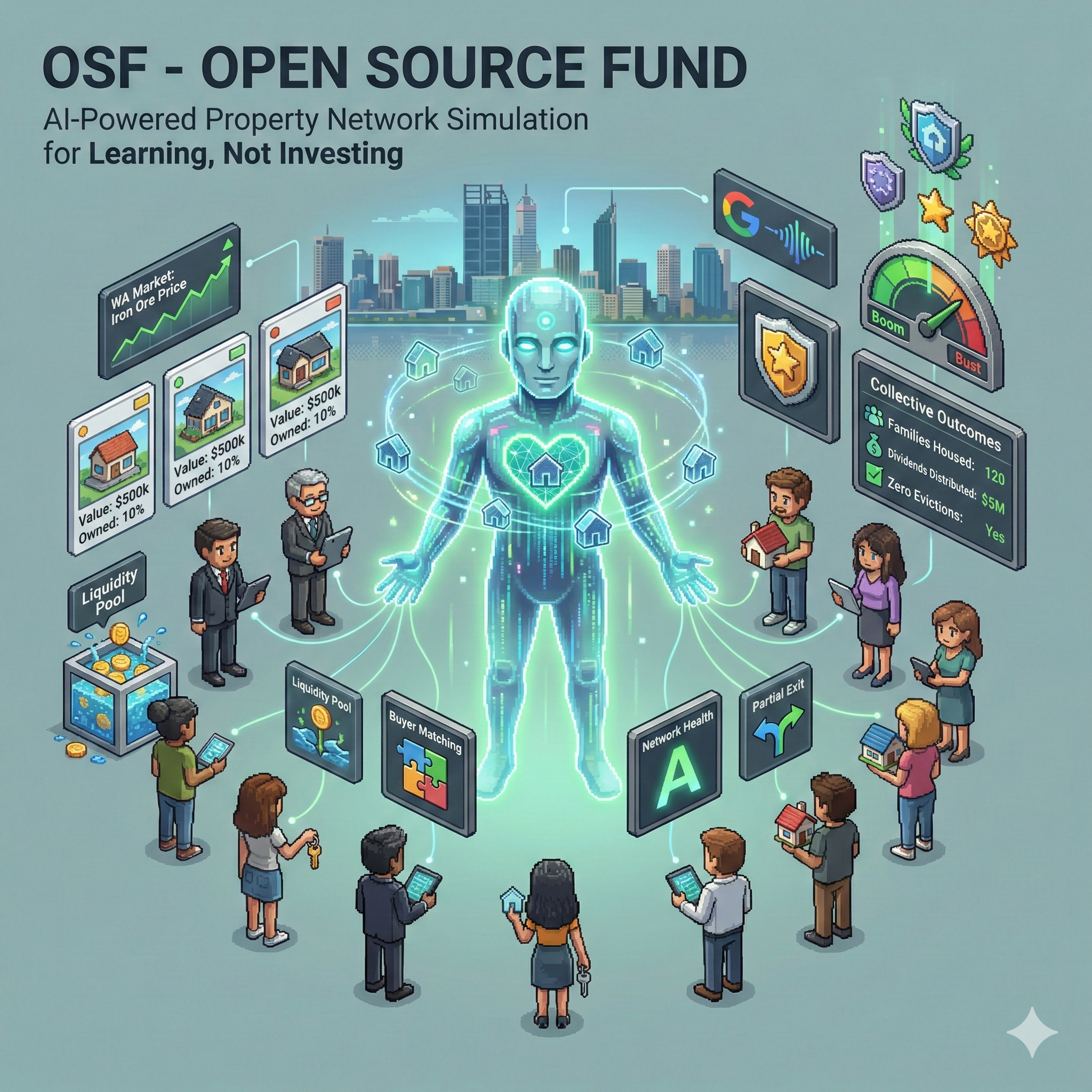

🏠 OSF - Open Source Fund

AI-driven property tokenization simulation for learning, not investing

> What is OSF?

OSF (Open Source Fund) is an educational simulation that demonstrates how AI could manage a transparent, community-governed property investment network. Built for the Gemini 3 Hackathon (Marathon Agent track), it allows users to explore property tokenization concepts without any financial risk.

| Aspect | Details |

|---|---|

| Type | Educational sandbox |

| Stack | SvelteKit, FastAPI, SQLite |

| AI | Gemini 2.0 Flash, Imagen 3 |

| Hackathon | Gemini 3 (Deadline: Feb 9, 2026) |

| Track | Marathon Agent |

⚠️ Note: This is a hackathon project for educational purposes. No real money, no real assets, no financial advice.

> Demo Video

Watch the 3-minute walkthrough of OSF in action:

> Podcast: Simulating a Self-Healing Housing Market

Listen to the deep-dive discussion on OSF's architecture and concepts:

> Architecture

graph TB

subgraph Frontend["Frontend (SvelteKit)"]

UI[Simulation Dashboard]

Clock[Network Clock]

Chat[Governor Chat]

end

subgraph Backend["Backend (FastAPI)"]

API[API Layer]

Batch[Batch Processor]

NPC[NPC Manager]

Events[Event Generator]

end

subgraph AI["Gemini AI"]

Flash[Gemini 2.0 Flash]

Imagen[Imagen 3]

end

subgraph Data["Data Layer"]

DB[(SQLite)]

Pool[Property Pool]

Avatars[Avatar Pool]

end

UI --> API

Clock --> API

Chat --> Flash

API --> Batch

Batch --> Flash

Batch --> NPC

NPC --> Events

Events --> DB

Imagen --> Pool

Imagen --> Avatars

> Two-Phase Processing Model

The core innovation is a two-phase architecture that optimizes token usage while maintaining interactivity:

sequenceDiagram

participant User

participant Frontend

participant Backend

participant Gemini

Note over User,Gemini: Phase 1: Real-Time (Between Ticks)

User->>Frontend: Ask Governor question

Frontend->>Gemini: Stream request

Gemini-->>Frontend: Streaming response

Note over User,Gemini: Phase 2: Batch Tick (Monthly)

Backend->>Backend: Collect all state

Backend->>Gemini: Single batch call (~50K tokens)

Gemini-->>Backend: AI decisions + narrative

Backend->>Frontend: SSE broadcast

Frontend->>User: Month completed!

Phase Details

| Phase | Model | Context | Purpose |

|---|---|---|---|

| Real-time chat | Gemini Flash | ~10K tokens | Governor/Advisor Q&A |

| Batch processing | Gemini Flash | ~50K tokens | Monthly simulation tick |

| Property images | Imagen 3 | N/A | Isometric renders |

| Character avatars | Imagen 3 | N/A | NPC/user avatars |

> Marathon Agent Implementation

OSF demonstrates the Marathon Agent pattern through autonomous simulation:

graph LR

subgraph Thought["Thought Signature Cycle"]

O[Observation] --> A[Analysis]

A --> D[Decision]

D --> Act[Action]

Act --> R[Reflection]

R --> O

end

subgraph Marathon["Marathon Mode"]

Start[Start] --> Tick[Auto-tick 2s]

Tick --> NPCs[11 NPCs Decide]

NPCs --> Log[AI Thinking Tab]

Log --> Tick

end

Marathon Mode Features

| Feature | Implementation |

|---|---|

| Duration | 120 months (10 years) at 2s/tick ≈ 4 hours |

| NPCs | 11 unique personalities with goal-driven behavior |

| Self-correction | NPCs adjust risk tolerance based on performance |

| Visible reasoning | AI Thinking tab shows all decisions live |

| Session continuity | Tracks elapsed time and total months |

> Self-Healing Network

Unlike traditional markets, OSF can detect and recover from stress:

graph TB

subgraph Detect["Sense & Diagnose"]

M[Monitor Metrics] --> D[Diagnose Root Cause]

end

subgraph Respond["Respond & Verify"]

D --> R[Activate Countermeasures]

R --> V[Verify Success]

V --> L[Learn & Improve]

end

subgraph Strategies["Healing Strategies"]

S1[Liquidity Pool<br/>Deploy floor bids]

S2[Buyer-Seller Matching<br/>Connect distressed sellers]

S3[Partial Exit Program<br/>30% now, 70% over 6mo]

S4[Rent-to-Own Acceleration<br/>Alert tenants to buy in]

end

R --> S1

R --> S2

R --> S3

R --> S4

Health Indicators

| Metric | Healthy Threshold |

|---|---|

| Liquidity | >80% |

| Exit Queue | <5 requests |

| Trade Failures | <15% |

| Occupancy | >95% |

| Rent Collection | >98% |

> Explorable Roles

Users can experience property from 6 different perspectives:

| Role | Experience |

|---|---|

| Investor | Buy/sell tokens, track portfolio, vote on proposals |

| Renter | Select property, pay rent, request maintenance |

| Tenant | Rent-to-own pathway, equity accumulation |

| Homeowner | Equity access, rental income, property listing |

| Service Provider | Complete tasks as plumber, electrician, manager |

| Foundation | Stake tokens, enhanced governance, yields |

Connected Roles

When a homeowner accesses equity, their holdings appear in the investor view:

Homeowner accesses $50K equity

↓

Receives OSF tokens (marked "Your Home Equity")

↓

Tokens appear in Investor portfolio

↓

Tokens earn dividends like regular investments

> Cooperative Gamification

OSF intentionally avoids competitive mechanics:

| Traditional Games | OSF Approach |

|---|---|

| Beat other players | Contribute to network health |

| Maximize personal wealth | Support collective outcomes |

| Individual rankings | Network health grade (A-F) |

| Competitive leaderboards | Exploration achievements |

Collective Outcomes

| Outcome | What It Measures |

|---|---|

| Families Housed | Stable housing provided |

| Dividends Distributed | Shared with token holders |

| Equity Accessed | Homeowners helped |

| Crises Survived | Downturns weathered |

| Evictions | 0 (OSF prevents this) |

| Foreclosures | 0 (cooperative model) |

Exploration Achievements

- First Investment - Make your first token purchase

- Weathered Storm - Hold during a market downturn

- Witnessed Boom - Experience a boom market

- Saw Self-Healing - Watch the network recover

- Full Cycle - Complete a full boom-bust cycle

- Network Anchor - Maintain holdings during crisis

> WA Market Dynamics

The simulation is calibrated to Western Australian property data:

| Metric | Value | Source |

|---|---|---|

| Median house price (Perth) | ~$750,000 | REIWA |

| Rental vacancy rate | <1% | REIWA |

| Gross rental yield (houses) | ~4.5% | CoreLogic |

| Gross rental yield (units) | ~6.0% | CoreLogic |

| Population growth | ~2.3% | WA Treasury |

Boom-Bust Cycle

| Condition | Monthly Appreciation | Triggers |

|---|---|---|

| Boom | +0.6% to +1.2% | Iron ore >$150/t, pop growth >2% |

| Stable | +0.2% to +0.4% | Iron ore >$100/t |

| Stagnant | -0.1% to +0.1% | Extended peak, buyer hesitation |

| Declining | -0.5% to -0.2% | Iron ore <$100/t |

| Bust | -1.0% to -0.5% | Iron ore <$80/t, population outflow |

> Tech Stack

| Layer | Technology |

|---|---|

| Frontend | SvelteKit 2.0, Svelte 5 Runes, TypeScript |

| UI Components | shadcn-svelte, Lucide icons, Chart.js |

| Interactive Diagrams | @xyflow/svelte (Money Flow, Self-Healing) |

| Backend | FastAPI, Python 3.11+, SQLAlchemy 2.0 |

| Database | SQLite (demo) / PostgreSQL (production) |

| AI | Gemini 2.0 Flash (streaming), Imagen 3 |

| Real-time | Server-Sent Events (SSE) |

| Market Data | RBA, ABS, APRA, REIWA, PropTrack |

> API Overview

Clock Endpoints

# Get clock status

GET /network/clock/status

# Start marathon mode

POST /network/clock/start

# Force tick (debug)

POST /network/clock/force-tick

# SSE event stream

GET /network/clock/stream

AI Endpoints

# Chat with Governor (streaming)

GET /network/governor/chat/stream?message=How%20is%20the%20network?

# Portfolio advice

POST /network/advisor/portfolio

> Key Innovations

1. Batch Context Maximization

Single Gemini call processes entire monthly state instead of hundreds of individual requests.

2. Emergent NPC Dynamics

11 NPCs with unique personalities create realistic market behavior without scripting.

3. Self-Healing Mechanisms

Network can coordinate participants to solve problems traditional markets cannot.

4. Cooperative Design

Rewards network health and learning, not wealth accumulation or competition.

5. Connected Role State

Homeowner actions flow through to investor portfolios, demonstrating real token economics.

> Running Locally

# Backend

cd projects/osf-demo/backend

export GOOGLE_API_KEY=your_key

USE_SQLITE=true uvicorn src.main:app --port 8000

# Frontend

cd projects/osf-demo/frontend

npm run dev

> Project Status

This is a hackathon project submitted for the Gemini 3 Hackathon (Marathon Agent track). It demonstrates AI capabilities in autonomous, long-running simulations with cooperative mechanics.

What it is:

- Educational simulation

- Hackathon demo

- Proof of concept

What it is NOT:

- Financial product

- Investment advice

- Production system

> Links

- Track: Marathon Agent

- Prize Pool: $100,000

- Deadline: February 9, 2026